Consider the act of borrowing money. Cash Link USA offers a solution through an xcash loan. This option provides quick access to cash. Borrowers can receive up to N500,000. The Canadian Payday Loan Association recognizes the importance of understanding loan terms. Cash Link USA ensures a low-interest rate of 4% to 4.7% per month. Borrowers must act wisely and weigh the pros and cons. A comprehensive guide helps in making informed decisions. Cash Link USA encourages responsible borrowing. Act now and explore the benefits of an xcash loan.

Understanding Xcash Loans

What is an Xcash Loan?

Definition and features

An Xcash Loan provides a financial solution for those needing quick access to cash. The loan offers up to N500,000, making it suitable for various needs. Borrowers can enjoy low-interest rates, ranging from 4% to 4.7% per month. This feature makes the loan attractive compared to traditional lending options. The application process requires minimal documentation, which simplifies borrowing.

How it works

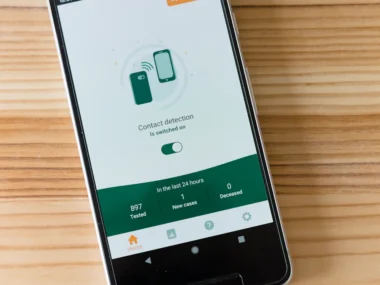

Borrowers can apply for an Xcash Loan through a user-friendly app. The process involves filling out an application form with basic information. Approval happens swiftly, often within minutes. Once approved, borrowers receive cash directly into their bank accounts. This speed allows individuals to address urgent financial needs promptly.

Types of Xcash Loans

Secured vs. Unsecured

Xcash Loans typically fall under unsecured loans. Borrowers do not need to provide collateral. This aspect benefits those without valuable assets. However, unsecured loans may carry higher interest rates. Borrowers should consider this when evaluating loan options.

Short-term vs. Long-term

Xcash Loans offer both short-term and long-term options. Short-term loans suit immediate financial needs. These loans usually have shorter repayment periods. Long-term loans provide more time for repayment. Borrowers can choose based on their financial situation and repayment capability.

Pros of Xcash Loans

Financial Flexibility

Xcash Loans provide financial flexibility for borrowers. Quick access to funds allows you to address urgent needs without delay. The application process remains simple and efficient. You can receive approval within minutes. This speed ensures that cash loans meet immediate financial demands.

A variety of loan options cater to different financial situations. Borrowers can choose from short-term or long-term loans. Each option offers unique benefits. Short-term loans suit those who need quick repayment. Long-term loans provide more time for financial planning. This flexibility makes cash loans a versatile choice.

Competitive Interest Rates

Xcash Loans offer competitive interest rates compared to other lenders. Rates range from 4% to 4.7% per month. This range provides potential savings for borrowers. Lower rates mean less financial strain over time. Borrowers can enjoy reduced monthly payments.

A comparison with other lenders highlights the advantages of Xcash Loans. Many traditional lenders charge higher rates. XcrossCash, another loan provider, offers similar rates but with lower loan amounts. Xcash Loans provide up to N500,000. This amount surpasses many competitors. Borrowers benefit from both higher loan amounts and lower interest rates.

Cons of Xcash Loans

Potential Risks

Xcash Loans may pose risks for borrowers. High interest rates can affect those with bad credit. Borrowers with poor credit scores often face increased costs. This situation can lead to financial strain.

Default risk is another concern. Missing payments can damage your credit score. A damaged credit score makes future borrowing difficult. Defaulting on cash loans can result in aggressive collection practices. Borrowers must consider these risks carefully.

Fees and Charges

Hidden costs can surprise borrowers. Many cash loans include fees not clearly stated upfront. These fees increase the total repayment amount. Borrowers should read all terms to avoid unexpected expenses.

Late payment penalties add to the cons of cash loans. Missing a payment deadline results in extra charges. These penalties can accumulate quickly. Borrowers need to manage payments to avoid additional costs.

Understanding the cons of payday loans helps in making informed decisions. Awareness of the cons of digital loan options ensures responsible borrowing. Evaluate all aspects before choosing a loan.

Frequently Asked Questions

Eligibility Criteria

Credit Score Requirements

Understanding credit score requirements is essential. Xcash Loans offer options for various credit profiles. A good credit score increases approval chances. However, loans for bad credit are available. Digital loan apps like Xcash provide flexibility. Applicants with lower scores can still access cash loans. This approach ensures more people benefit from financial solutions.

Income Verification

Income verification plays a crucial role in the application process. Xcash Loans require proof of income. Applicants must submit recent bank statements. These documents should cover three months of transactions. This step helps lenders assess repayment ability. Digital platforms streamline this process. Borrowers find it convenient and straightforward.

Application Process

Steps to Apply

Applying for an Xcash Loan involves simple steps. First, download the digital app. Fill out the online application form. Provide necessary personal details. Submit bank statements for income verification. Approval often occurs within a day. Online payday loans offer quick solutions. Day guaranteed approval enhances convenience.

Required Documentation

Documentation requirements remain minimal. Applicants need valid identification. Recent bank statements are essential. Proof of income supports the application. Digital loan apps simplify document submission. This process saves time and effort. Borrowers enjoy a seamless experience. Diego online lenders offer similar ease.

Additional Resources

Where to Find More Information

Xcash official website

Explore the Xcash official website for comprehensive details about their offerings. The platform provides insights into low-interest loans and application processes. Access up to N500,000 through the user-friendly app. The website guides you through every step of acquiring a loan. This resource ensures you understand all terms and conditions. Stay informed about interest rates and repayment options. The website serves as a reliable source for anyone considering payday loans.

Financial advice blogs

Financial advice blogs offer valuable insights into managing loans and banking relationships. These blogs provide expert opinions on payday loans and business standards. Learn how to navigate the complexities of online cash borrowing. Discover strategies to maintain healthy banking practices. Financial experts share tips on avoiding hidden fees and penalties. Blogs discuss the pros and cons of different loan types. Gain knowledge on balancing personal and business financial needs. These resources help you make informed decisions about payday loans.

Evaluating loans requires careful consideration. Xcash loans offer quick access to funds, but understanding the pros and cons is crucial. Weigh the benefits of competitive interest rates against potential risks like high fees. Financial literacy helps you make informed choices. Consider your credit score’s impact on loan terms. Different lenders, including York Online Personal Loans, have unique criteria. The Usurious Loans Act protects borrowers from excessive rates. Payday options provide flexibility, yet responsible borrowing remains essential. Assess your financial situation before deciding. Make sure payday loans align with your needs and goals.