Loan apps in Nigeria have become a lifeline for many. Economic hardships push more Nigerians to seek credit, and loan apps offer a convenient solution. These platforms provide quick access to funds with interest rates often less than 30% per year. Low-interest rates are crucial for borrowers trying to manage expenses without falling into debt traps. Finding a loan app in Nigeria with low interest can make a significant difference. This blog will explore the top 15 apps that offer competitive rates, helping you make informed financial decisions.

Overview of Loan Apps in Nigeria

Growth of Digital Lending

Rise of Fintech in Nigeria

Fintech companies have transformed the financial landscape in Nigeria. These innovative platforms offer digital solutions that make borrowing money easier. Many Nigerians now prefer fintech loan apps because they provide quick access to funds. The rise of fintech has created more options for borrowers who need flexibility and speed.

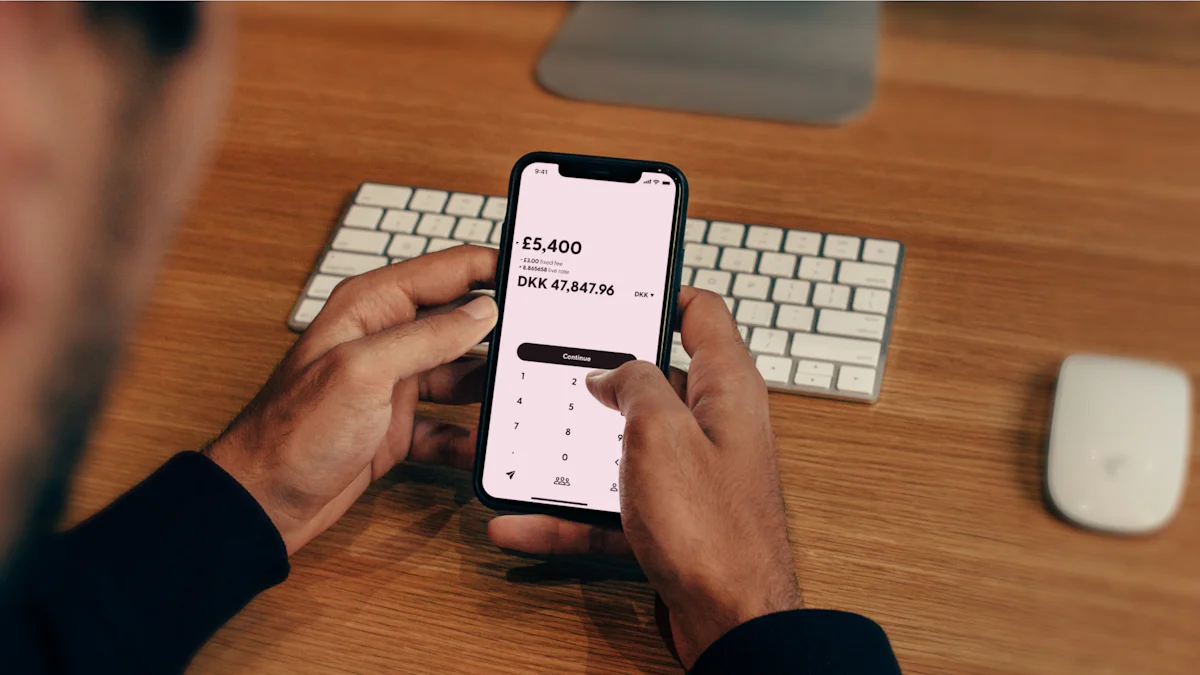

Accessibility and Convenience

Loan apps bring convenience right to your smartphone. You can apply for a loan anytime without visiting a bank. The process is straightforward, with minimal paperwork required. This accessibility makes loan apps an attractive choice for those seeking immediate financial assistance.

Importance of Low Interest Rates

Financial Impact on Borrowers

Low interest rates play a crucial role in managing finances. Borrowers can repay loans without excessive financial strain. Loan apps often offer competitive rates, making them a viable option for many. Choosing an app with low interest helps you avoid falling into debt traps.

Comparison with Traditional Banks

Loan apps differ significantly from traditional banks. Loan apps typically provide faster approval processes. Traditional banks may require lengthy forms and collateral. Loan apps focus on customer service and offer unsecured loans. Traditional banks often have higher interest rates. Borrowers find loan apps more appealing due to their streamlined approach and lower costs.

Top 15 Loan Apps in Nigeria

QuickCheck

Loan Range and Interest Rates

QuickCheck offers loans ranging from ₦1,500 to ₦500,000. You can choose a repayment term between 91 days and one year. Interest rates start as low as 5% monthly for your first loan. The app uses machine learning to evaluate applications quickly. QuickCheck provides a secure and reliable platform without needing collateral.

Application Process

Applying for a loan with QuickCheck is simple. You need basic information and bank account details. The app prioritizes privacy and security, using encryption to protect your data. You can enjoy a seamless experience with instant decisions.

Carbon

Loan Range and Interest Rates

Carbon provides a flexible loan range with interest rates between 2% to 30% monthly. The app offers an APR from 23% to 68.3%. Carbon Loan app stands out for its competitive rates and user-friendly interface. You can access funds quickly without hassle.

Application Process

The Carbon Loan app makes applying easy. You fill out a straightforward form on your smartphone. Approval happens fast, so you get funds when you need them. Carbon focuses on providing a smooth and efficient process.

Aella Credit

Loan Range and Interest Rates

AellaCredit offers loans with monthly interest rates from 6% to 20%. The Aella Credit Loan App provides an APR ranging from 22% to 264%. You can find a suitable option that fits your financial needs. Aella ensures transparency in its offerings.

Application Process

The Aella App simplifies the application process. You submit necessary details through the app. AellaCredit evaluates your application swiftly. You receive funds directly into your account, making it convenient for you.

Palmcredit

Loan Range and Interest Rates

Palmcredit offers loans with monthly interest rates ranging from 14% to 24%. You can choose a repayment term that suits your needs. The app provides an APR between 48% and 56%. Palmcredit gives you access to funds without the hassle of traditional bank procedures.

Application Process

Applying for a loan with Palmcredit is straightforward. You need to download the app and provide basic information. The process is quick, allowing you to receive funds directly into your account. Palmcredit ensures a smooth experience with minimal documentation.

Branch

Loan Range and Interest Rates

The Branch Loan App is known for its low interest rates. You can borrow amounts that fit your financial situation. Branch provides flexible terms and competitive rates. This makes the Branch app a popular choice for many Nigerians seeking quick loans.

Application Process

The Branch Loan application process is user-friendly. You fill out a simple form on your smartphone. Approval happens fast, so you get funds when needed. Branch focuses on providing a seamless experience without the need for collateral.

FairMoney

Loan Range and Interest Rates

FairMoney offers immediate loans at competitive interest rates. You can access funds quickly with terms that match your needs. FairMoney provides a reliable option for those looking to avoid traditional bank loans.

Application Process

The application process with FairMoney is efficient. You submit necessary details through the app. Approval is swift, ensuring you receive funds promptly. FairMoney prioritizes customer convenience and security.

P2Vest

Loan Range and Interest Rates

P2Vest stands out among loan apps in Nigeria for its competitive interest rates. Borrowers can access loans with interest rates that are notably lower than many traditional banks. The app offers a flexible loan range, allowing users to choose amounts that suit their financial needs. This flexibility makes P2Vest an attractive option for those looking to manage expenses without high-interest burdens.

Application Process

The application process for P2Vest is straightforward and user-friendly. You need to download the app from the Google Play Store or the Apple Store. Basic information and bank account details are required. The app uses advanced technology to ensure quick approval. Users appreciate the seamless experience and the security measures in place to protect personal data. P2Vest prioritizes customer satisfaction by offering a hassle-free loan application process.

ALAT

Loan Range and Interest Rates

ALAT By Wema provides a unique loan experience with its Alat loan offerings. The ALAT app offers loans with competitive interest rates, making it a preferred choice for many Nigerians. Users can expect an Annual Percentage Rate (APR) that is favorable compared to traditional banks. The Alat loan app allows you to select loan amounts that align with your financial goals.

Application Process

Applying for a loan through the ALAT app for Android is simple. You need to provide basic details and your BVN for verification. The app ensures a quick approval process, so you receive funds promptly. ALAT focuses on providing a smooth user experience with minimal documentation. The app’s usability and security features make it a reliable choice for borrowers.

Xcrosscash

Loan Range and Interest Rates

Xcrosscash offers instant loans ranging from N10,000 to N50,000. The app is known for its low-interest rates, which help users manage their finances effectively. Borrowers can enjoy flexible repayment terms, making Xcrosscash a popular choice among loan apps in Nigeria. The app’s interest rates are competitive, providing a viable alternative to traditional banking options.

Application Process

The Xcrosscash application process is designed for ease and convenience. You can apply directly through the app, available on the Google Play Store. Basic information and bank account details are necessary for application. The app promises quick approval and fund disbursement, ensuring you get the financial assistance you need without delay. Xcrosscash emphasizes user trust and data security throughout the process.

Kuda

Loan Range and Interest Rates

Kuda Loan offers a seamless experience for those seeking financial assistance. You can access loans up to ₦150,000. The app provides competitive interest rates, making it a popular choice among mobile loan apps. Kuda Loan ensures that borrowers find the terms favorable compared to traditional banking options. The focus on low-interest rates helps users manage their finances effectively.

Application Process

The application process for Kuda Loan is straightforward. You download the app and provide basic information, including your account details. Approval happens quickly, so you receive funds without delay. Kuda Loan prioritizes user convenience and security, ensuring a reliable experience. This makes Kuda one of the most trusted loan apps reliable in Nigeria.

Migo Loan

Loan Range and Interest Rates

The Migo loan app offers flexible loan amounts tailored to your needs. Interest rates are competitive, providing an appealing alternative to traditional banks. Migo Loan focuses on offering loans with low-interest rates, helping you avoid high financial burdens. The app’s transparency in loan terms makes it a trustworthy option.

Application Process

Applying for a Migo Loan is easy. You fill out a simple form on your smartphone. The app evaluates your application swiftly, ensuring you get funds promptly. Migo Loan emphasizes user satisfaction and data security, making it one of the apps reliable in Nigeria.

Specta

Loan Range and Interest Rates

Specta provides instant loans with a focus on low-interest rates. You can choose from a variety of loan amounts that suit your financial goals. Specta stands out among loan apps offering loans with competitive terms. This approach helps users manage their expenses without falling into debt traps.

Application Process

The application process with Specta is user-friendly. You submit necessary details through the app, available on major platforms. Approval is quick, allowing you to access funds when needed. Specta prioritizes customer trust and security, ensuring a smooth experience.

Okash

Loan Range and Interest Rates

Okash provides a fantastic option for those seeking a low-interest rate loan in Nigeria. You can borrow amounts ranging from ₦3,000 to ₦500,000. The Okash interest rate starts at a competitive level, making it one of the appealing low-interest loan apps available. Borrowers appreciate the flexibility in repayment terms, which range from 91 days to a year. This flexibility helps you manage finances without stress.

Application Process

Applying for a loan with Okash is straightforward. Download the app on your smartphone and fill out the required information. The process requires basic details and your bank account information. Approval happens quickly, allowing you to access funds without delay. Okash prioritizes user convenience and security, ensuring a smooth experience for Nigerians seeking financial assistance.

Renmoney

Loan Range and Interest Rates

Renmoney stands out among low-interest rate loan apps in Nigeria. You can access loans from ₦50,000 to ₦6,000,000. The interest rates are designed to be competitive, providing a low-interest rate loan option that suits various financial needs. Renmoney offers flexible repayment terms, allowing you to choose what fits best. This flexibility makes it a preferred choice for many Nigerians.

Application Process

The application process with Renmoney is easy and efficient. You need to download the app and provide necessary information like your BVN and employment details. The app ensures quick approval, so you receive funds promptly. Renmoney focuses on customer satisfaction and security, making it a reliable option for those looking for low-interest rates in Nigeria.

AjoCard

Loan Range and Interest Rates

AjoCard offers a unique approach to low-interest rate loans in Nigeria. You can borrow amounts that align with your financial goals. The interest rates are low, making it an attractive choice among low-interest loan apps. AjoCard provides flexible terms, ensuring you find a plan that works for you. This approach helps you manage expenses without high-interest burdens.

Application Process

Applying for a loan with AjoCard is simple. Download the app and complete the application with your personal and bank details. The process is designed to be quick, with fast approval times. AjoCard emphasizes user trust and data security, ensuring a hassle-free experience for Nigerians seeking low-interest rate loans.

Benefits of Using Loan Apps

Quick Approval

Loan apps in Nigeria offer a fast approval process. You can get access to funds without waiting for days. This quick approval is a game-changer for those who need immediate financial support.

Time Efficiency

Time efficiency is a significant advantage of using loan apps. You can apply for a loan and receive approval within minutes. The PalmPay Loan App and QuickCheck loan app are known for their rapid processing times. This efficiency helps you manage urgent expenses without delay.

Minimal Documentation

Loan apps require minimal documentation. Traditional banks often ask for extensive paperwork. Loan apps like PalmCredit simplify the process. You only need basic information to get started. This approach makes borrowing more accessible for many Nigerians.

Flexibility in Loan Terms

Loan apps provide flexibility in terms. You can choose repayment plans that suit your financial situation. This flexibility allows you to manage your finances better.

Customizable Repayment Plans

Customizable repayment plans are a key feature of loan apps. You can select a plan that aligns with your budget. The PalmPay Loan App offers various options. This customization helps you avoid financial strain.

Varied Loan Amounts

Loan apps offer varied loan amounts. You can borrow according to your needs. The PalmCredit Loan App allows you to access different amounts. Whether you need a small or large sum, these apps cater to your requirements. This variety supports diverse financial goals in Nigeria.

Potential Drawbacks

Loan apps in Nigeria offer many benefits, but there are some drawbacks you should consider. Understanding these potential issues helps you make informed decisions when choosing a loan app.

High Penalties for Late Payments

Late payments can lead to high penalties. Loan apps often impose significant charges if you miss a payment deadline. These penalties can quickly add up and create a financial burden. You might find yourself paying more than you initially borrowed.

Financial Consequences

Missing a payment can have serious financial consequences. The added costs from penalties can strain your budget. You might struggle to meet other financial obligations. It’s crucial to plan your repayments carefully to avoid these extra charges.

Impact on Credit Score

Late payments can negatively impact your credit score. Loan apps report your payment history to credit bureaus. A lower credit score can affect your ability to borrow in the future. Maintaining a good payment record is essential for keeping your credit score healthy.

Privacy Concerns

Privacy concerns are another drawback of using loan apps. Many apps require access to personal information. This access raises questions about data security and user trust.

Data Security Issues

Data security issues can arise with loan apps. Your personal information might be at risk if the app lacks proper security measures. Unauthorized access to your data can lead to identity theft or fraud. Choosing an app with strong security protocols is vital to protect your information.

User Trust

User trust is crucial when dealing with financial apps. You need to feel confident that your data is safe. Some users worry about how their information is used or shared. Reading reviews and researching the app’s privacy policies can help build trust.

Practical Advice for Securing Loans

Understanding Terms and Conditions

Grasping the terms and conditions of a loan is crucial. You need to pay attention to every detail to avoid surprises later.

Key Clauses to Watch

Look out for key clauses in the loan agreement. These clauses often include information about penalties, fees, and repayment schedules. Knowing these details helps you manage your loan effectively. You should also check if there are any hidden charges that might affect your repayment plan.

Interest Rate Calculations

Interest rates can be tricky. Understanding how lenders calculate interest rates is essential. Some apps offer daily rates while others use monthly or annual rates. For example, Kuda Loan offers a 0.3% daily interest rate. This knowledge helps you compare different loan options and choose the best one for your needs.

Tips for Successful Applications

Applying for a loan can be straightforward if you prepare well. Following some simple tips can increase your chances of approval.

Preparing Necessary Documents

Having all necessary documents ready speeds up the application process. Most loan apps require basic information like your bank account details and identification. Some might ask for proof of income or employment. Being prepared with these documents ensures a smooth application process.

Improving Creditworthiness

Improving your creditworthiness boosts your chances of getting a loan. Paying bills on time and reducing outstanding debts can help. A good credit score shows lenders that you are a reliable borrower. This reliability can lead to better loan terms and lower interest rates.

Explore the top loan apps in Nigeria to find low-interest rates and quick access to funds. These apps offer user-friendly interfaces and minimal documentation, making borrowing easy and efficient. Choose the right app by considering your financial needs and goals. Evaluate interest rates and repayment terms to ensure alignment with your budget. Personal financial planning plays a crucial role in avoiding debt traps. Make informed decisions to enjoy the benefits of these convenient financial tools.