Loan apps in Nigeria have become a lifeline for many. With instant loan options, these apps offer quick financial relief. A recent study shows that 27% of Nigerians use these apps to manage expenses. The ALAT Loan App and Eyowo Loan App provide solutions without needing a BVN. This is crucial for privacy and accessibility. Understanding the LNDDO Loan App Requirements ensures you make informed choices. Navigating a loan app without BVN in Nigeria requires knowledge of terms and conditions. This empowers you to choose wisely among instant loan apps.

Overview of Loan Apps Without BVN

What is a BVN?

Definition and purpose

A Bank Verification Number (BVN) serves as a unique identifier for individuals in the Nigerian banking system. The Central Bank of Nigeria introduced the BVN to curb fraudulent activities and enhance security. Each person gets a unique number linked to their bank accounts. This ensures that financial transactions remain secure and traceable.

Why some apps don’t require it

Some loan apps in Nigeria choose not to require a BVN. These apps prioritize accessibility and privacy for users. Many people may not have a BVN or prefer not to share it. FairMoney, Carbon, and Okash are examples of loan apps approved for use without a BVN. These platforms offer instant loans without BVN, making them appealing to a broader audience. Users appreciate the ease and speed of accessing funds without needing a BVN.

Benefits of Using Loan Apps Without BVN

Accessibility

Loan apps without BVN include Eyowo and Jumia Pay. These platforms make borrowing money easy for everyone. You only need a phone number to get started. This approach opens doors for many who might not have access to traditional banking services. People without a bank account can still access funds quickly. This feature makes these apps a popular choice in Nigeria without BVN requirements.

Speed of approval

Instant loans without BVN provide quick financial relief. Aella Credit and Quickteller offer rapid loan approvals. Users can receive funds within minutes of applying. The process is straightforward and hassle-free. No need to wait days for approval. This speed makes these apps ideal for urgent financial needs. Quick access to funds can be a lifesaver in emergencies.

Top 10 Loan Apps in Nigeria

FairMoney Loan App

FairMoney Loan App offers a seamless experience for users. You can access loans ranging from ₦1,000 to ₦1,000,000. The approval process takes just 5 minutes. No need for a BVN or collateral. This app uses smartphone data and repayment history to determine loan amounts. Over 10 million downloads highlight its popularity. Flexible repayment plans make it user-friendly.

Okash Loan App

Okash Loan App provides quick financial solutions. Users can borrow between ₦3,000 and ₦500,000. Approval happens within minutes. No BVN number is required. Managed by Blue Ridge Microfinance Bank, this app ensures security and reliability. Okash focuses on accessibility and speed, making it a top choice for many Nigerians.

Carbon Loan App

Carbon Loan App stands out with its unique features. Loan amounts range from ₦1,500 to ₦1,000,000. Approval is fast, often within minutes. Users enjoy the convenience of not needing a BVN. Carbon offers additional services like bill payments and investments. This app provides a comprehensive financial solution.

PalmCredit Loan App

PalmCredit Loan App offers a user-friendly experience for quick financial needs. You can access loans ranging from ₦2,000 to ₦100,000. Approval happens swiftly, often within minutes. No need for a BVN or collateral. The app focuses on simplicity and speed, making it appealing for urgent situations. Users enjoy flexible repayment options that suit various financial conditions.

Aella Credit Loan

Aella Credit Loan provides a reliable solution for those seeking instant funds. Loan amounts range from ₦1,500 to ₦700,000. Approval is quick, ensuring you get the money when needed. The app does not require a Bank Verification Number, enhancing privacy and accessibility. Unique features include personalized loan offers based on your financial behavior. Aella Credit stands out for its customer-centric approach.

Yanzu Afrika Loan App

Yanzu Afrika Loan App caters to individuals looking for fast and easy loans. You can borrow between ₦5,000 and ₦200,000. The approval process is efficient, with funds available in minutes. No BVN is needed, which makes the app accessible to a wider audience. Yanzu Afrika offers competitive interest rates and flexible repayment plans, ensuring a smooth borrowing experience.

LairaPlus Loan App

LairaPlus Loan App offers a straightforward way to get financial help. You can access loans ranging from ₦2,000 to ₦50,000. The approval process takes just a few minutes in Nigeria. No need for a Bank Verification Number. This app focuses on simplicity and speed. Users appreciate the easy application process. LairaPlus provides flexible repayment options that suit different financial needs.

Branch Loan App

Branch Loan App gives you access to quick funds without hassle. Loan amounts range from ₦1,000 to ₦200,000. Approval happens swiftly, often within minutes in Nigeria. This app doesn’t require a BVN, making it accessible to many. Users enjoy the convenience and reliability. Branch also offers features like bill payments and money transfers. These additional services make it a comprehensive financial tool.

Renmoney Loan App

Renmoney Loan App provides a reliable solution for those in need of cash. You can borrow between ₦6,000 and ₦500,000. The approval process is fast, usually taking just a few minutes in Nigeria. No need for collateral or complex paperwork. Renmoney focuses on customer satisfaction with personalized loan offers. This app stands out for its user-friendly interface and competitive interest rates.

QuickCheck Loan App

QuickCheck Loan App offers a seamless experience for users in Nigeria. You can access loans ranging from ₦1,500 to ₦500,000. Approval happens swiftly, often within minutes. Users appreciate the convenience and speed of this app. QuickCheck does not require a BVN, making it accessible to many Nigerians.

Loan amounts available

QuickCheck provides a range of loan amounts to suit different needs. You can borrow between ₦1,500 and ₦500,000. This flexibility allows you to choose a loan that fits your financial situation. Whether you need a small amount or a larger sum, QuickCheck has options for you.

Approval time

The approval process with QuickCheck is quick and efficient. You can receive approval within minutes of applying. This speed makes QuickCheck ideal for urgent financial needs. No need to wait days for approval. QuickCheck ensures you get the funds when you need them most.

Unique features

QuickCheck stands out with its user-friendly interface and unique features. The app uses smartphone data to assess creditworthiness. This approach allows QuickCheck to offer personalized loan amounts. Users enjoy flexible repayment plans that suit their financial conditions. QuickCheck also provides educational resources to help users manage their finances better. These features make QuickCheck a popular choice among loan apps in Nigeria.

Considerations When Choosing a Loan App

Choosing the right loan app in Nigeria can feel overwhelming. With so many options, you need to consider several factors. Let’s break down the key points to help you make an informed decision.

Interest Rates

Comparison of rates

Interest rates vary across different loan apps. Some apps offer competitive rates, while others might charge higher fees. Comparing rates is crucial. FairMoney Loan app gives you an idea of what to expect. Apps like PalmCredit and Aella Credit provide quick loans without collateral. These apps focus on creditworthiness and financial behavior. Understanding the differences helps you choose the best option for your needs.

Impact on repayment

Interest rates directly affect your repayment amount. Higher rates mean larger payments over time. Apps like Yanzu Afrika offer loans up to N10,000 without BVN verification. This provides a convenient solution for quick funds. Consider how the rates impact your budget. Make sure you can comfortably manage the repayments.

Repayment Terms

Flexibility

Flexibility in repayment terms is essential. Some apps offer more lenient schedules. Others might have strict timelines. EasyBuy and Easybuy Nigeria provide options that cater to different financial situations. Look for apps that allow adjustments if needed. Flexibility ensures you can handle unexpected changes in your finances.

Penalties for late payment

Late payment penalties can add up quickly. Apps often charge fees for missed deadlines. Understanding these penalties is vital. Apps like Fairmoney Loan App offers insights into potential costs. Avoid surprises by reading the terms carefully. Choose apps with reasonable policies to avoid unnecessary expenses.

Security and Privacy

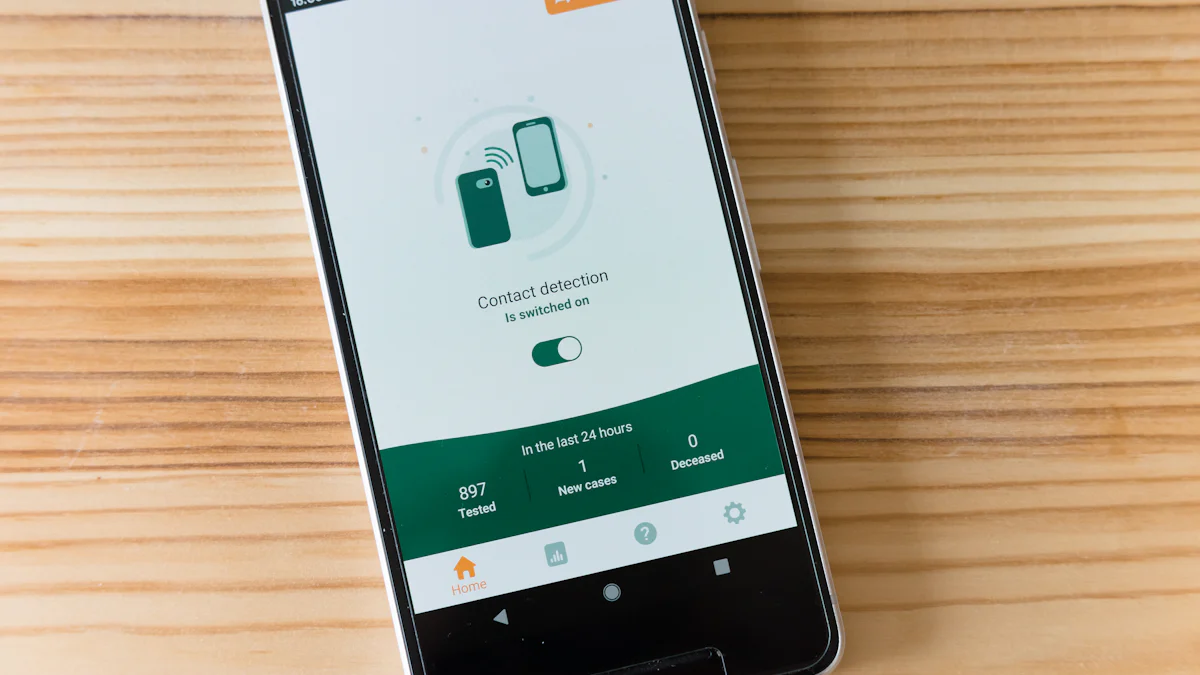

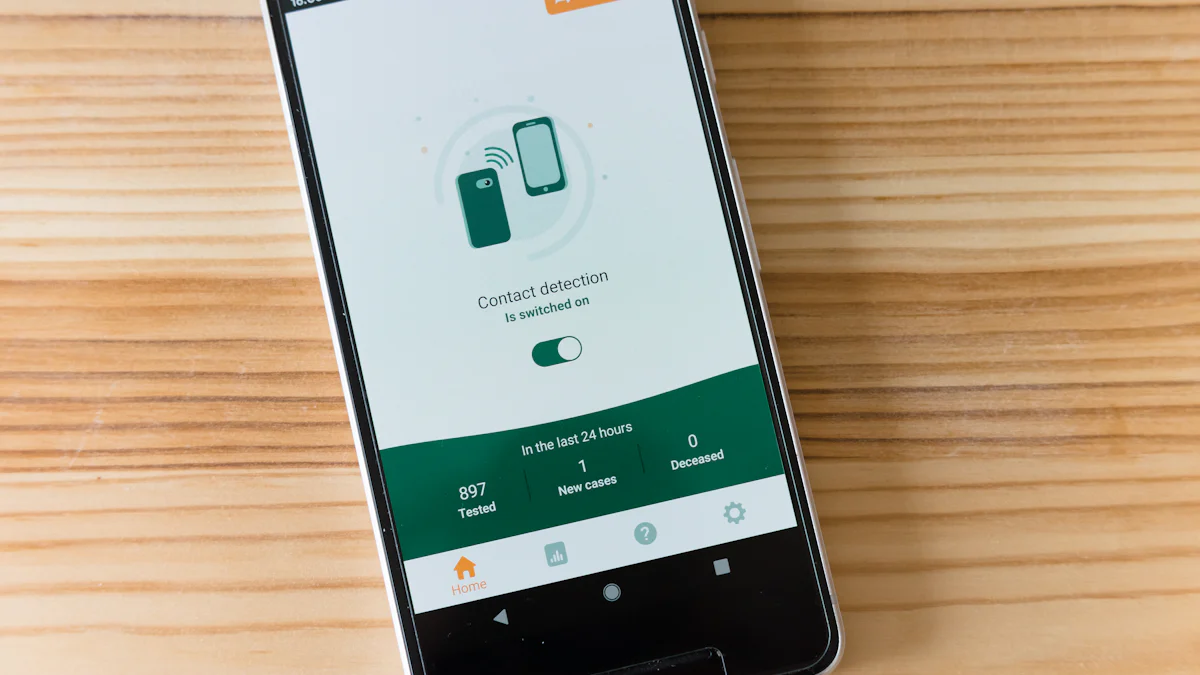

Data protection measures

Security is a top priority when using digital loan apps. Protecting your personal information is crucial. Apps should have robust data protection measures. DIGITAL LOAN APPS APPROVED in Nigeria prioritize user security. Ensure the app you choose uses encryption and secure servers. This keeps your data safe from unauthorized access.

User reviews and feedback

User reviews provide valuable insights into an app’s reliability. Check feedback from other users before committing. Apps with positive reviews often deliver better service. GOTV Review sections can guide your decision. Look for consistent praise for customer service and ease of use. Avoid apps with frequent complaints about hidden fees or poor support.

Choosing the right loan app in Nigeria requires careful consideration. By focusing on interest rates, repayment terms, and security, you can find an app that meets your needs. Remember to compare options and read reviews. This ensures you make a choice that supports your financial goals.

Loan apps without BVN offer significant benefits. Users enjoy quick access to funds and enhanced privacy. Apps like Renmoney and Branch provide user-friendly experiences. These apps ensure fast approvals and flexible terms. Researching different options helps you find the best fit. Always consider interest rates and repayment terms. Responsible borrowing remains crucial. Make sure to understand the terms before committing. Choose wisely to manage your financial needs effectively.