Icoin Loan faces scrutiny due to its inclusion on the CBN Blacklist. Understanding the relationship between Icoin Loan and the CBN Blacklist holds importance for anyone involved in financial activities. This knowledge impacts financial security and regulation. The CBN Blacklist identifies entities that violate lending regulations. Awareness of these practices helps you navigate the financial ecosystem safely.

Understanding Icoin Loan

Definition and Overview

What is Icoin Loan?

Icoin Loan provides a variety of loan products to cater to different needs. The offerings include personal loans, business loans, and payday loans. Icoin Loan operates as an innovative app, delivering instant online loans to individuals and businesses in Nigeria. The company emphasizes excellent customer service, flexible repayment options, and low-interest rates.

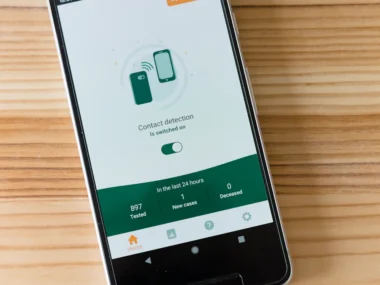

How it operates

Icoin Loan functions through a user-friendly mobile application. Customers can apply for loans directly on the app. The approval process is swift, often providing funds within minutes. The app evaluates creditworthiness based on user data and determines loan eligibility. Borrowers receive funds directly into their bank accounts after approval.

Benefits and Risks

Potential advantages

Icoin Loan offers several benefits to users. The service provides quick access to funds, which helps in emergencies. Flexible repayment options allow borrowers to choose terms that suit their financial situation. Low-interest rates make borrowing more affordable compared to traditional lenders. The app’s convenience eliminates the need for physical paperwork or visits to a bank.

Associated risks

Icoin Loan also presents certain risks. Short repayment periods, ranging from 6 to 14 days, can pose challenges for borrowers. High-interest rates on overdue payments, between 2% to 7% per day, may lead to increased debt. Users might fall into a cycle of borrowing from multiple apps to repay existing loans. This practice can result in financial instability and potential ruin.

Exploring the CBN Blacklist

What is the CBN Blacklist?

Purpose and Significance

The CBN Blacklist serves as a critical tool for maintaining financial integrity. The Central Bank of Nigeria (CBN) uses this list to identify entities that violate lending regulations. Financial institutions rely on the blacklist to prevent unethical practices. The blacklist helps protect consumers from fraudulent activities.

Criteria for Inclusion

Entities face blacklisting for various offenses. Violations include fraud, forgery, and breaches of banking regulations. The CBN evaluates evidence before adding any entity to the list. Financial institutions must adhere to these guidelines to ensure compliance.

Implications of Being Blacklisted

Impact on Financial Activities

Blacklisting affects an entity’s ability to operate within the financial system. Banks may refuse services to blacklisted individuals or organizations. Access to loans and credit facilities becomes restricted. The blacklist impacts the reputation and trustworthiness of those involved.

Legal and Regulatory Consequences

Legal consequences follow blacklisting. Entities face investigations and potential legal actions. Regulatory bodies may impose fines or sanctions. Resolving blacklisting issues requires providing evidence to the CBN or relevant authorities. Compliance with regulations becomes essential for regaining credibility.

The Intersection of Icoin Loan and CBN Blacklist

Case Studies

Examples of blacklisted entities

The Central Bank of Nigeria (CBN) has blacklisted several entities due to unethical practices. Fake loan apps have exploited unsuspecting Nigerians, leading to their inclusion on the CBN Blacklist. The blacklist aims to protect citizens from financial harm. The CBN’s commitment to safeguarding citizens remains evident through these actions.

Analysis of specific cases

The CBN Blacklist includes entities involved in fraudulent activities. The BVN Blacklisting Process plays a crucial role in identifying such entities. The BVN system helps prevent fraud by maintaining a record of individuals with questionable financial activities. The NIBSS Watchlist also identifies individuals involved in financial fraud. These measures ensure the integrity of the financial sector.

Practical Applications and Considerations

How to navigate the risks

Navigating the risks associated with blacklisted entities requires vigilance. Individuals must verify the legitimacy of financial service providers before engaging with them. Checking for CBN approval ensures compliance with regulations. Consumers should avoid entities with a history of unethical practices.

Strategies for compliance

Entities must adhere to guidelines to avoid blacklisting. Compliance with CBN regulations is essential for maintaining credibility. Financial institutions should implement robust systems to detect and prevent fraudulent activities. Regular audits and transparent operations help build trust with consumers.

The Role of Credit and Lendsqr in the Ecosystem

Credit in Nigeria

Overview of the credit ecosystem

The credit ecosystem in Nigeria plays a vital role in the financial landscape. Credit allows individuals and businesses to access funds for various needs. The system relies on credit information to evaluate borrowers’ creditworthiness. Credit reporting helps lenders make informed decisions. This process ensures that loans are granted to individuals with the capacity to repay.

Credit bureaus collect and maintain data on borrowers. These organizations provide lenders with essential credit information. The data includes payment history and outstanding debts. This information helps lenders assess the risk of lending to specific individuals. Credit bureaus contribute to a more transparent and efficient credit ecosystem.

Role of credit bureaus

Credit bureaus in Nigeria serve as crucial players in the financial sector. These institutions gather and analyze data related to individuals’ credit activities. Lenders rely on this information to determine loan eligibility. Credit bureaus help reduce the risk of default by providing accurate credit reports. This service enhances trust between lenders and borrowers.

The Nigeria Interbank Settlement System (NIBSS) collaborates with credit bureaus. NIBSS ensures that data is securely shared among financial institutions. This collaboration strengthens the overall credit ecosystem. It promotes responsible lending practices and protects consumers from potential financial harm.

Lendsqr and Its Impact

How Lendsqr operates

Lendsqr stands out as a leading player in the credit ecosystem. The company aims to bridge the credit gap in Africa, including Nigeria. Lendsqr provides practical solutions for fair access to credit. The company uses advanced technology to streamline the lending process. Lendsqr APIs facilitate seamless integration with other financial platforms.

Lendsqr offers a comprehensive loan management system. The platform empowers lenders to manage their lending operations efficiently. Lendsqr account holders benefit from a user-friendly interface. The system ensures that lenders can assess loan applications quickly. This efficiency leads to faster approval and disbursement of funds.

Influence on lenders and borrowers

Lendsqr significantly impacts both lenders and borrowers in Nigeria. The platform enables lenders to make data-driven decisions. Lendsqr’s partnership with Mono provides access to customers’ bank statement data. This information helps lenders evaluate borrowers’ repayment capacity. Lendsqr ensures that lenders accept only creditworthy individuals.

Borrowers benefit from Lendsqr’s transparent lending practices. The platform offers fair interest rates and flexible repayment terms. Lendsqr’s commitment to clear communication builds trust with borrowers. The company’s efforts contribute to a more inclusive credit ecosystem. Lendsqr’s impact extends beyond Nigeria, influencing the broader African financial landscape.

Lendsqr’s dedication to ethical practices aligns with global standards. The company recognizes the importance of blacklists in protecting individuals. Blacklists include entities involved in fraudulent activities. Organizations like the Terrorist Screening Center in the United States of America maintain such lists. These blacklists protect individuals from financial threats.

Broader Implications for Africa

Financial Regulations Across Africa

Comparison with other African countries

Financial regulations vary across Africa. Each country establishes unique rules to manage lending practices. Some nations implement strict guidelines to protect consumers. Others focus on promoting innovation in financial services. The Central Bank of Nigeria uses the Bank Verification Number system. This system ensures secure transactions and reduces fraud.

Countries like Kenya and South Africa have advanced credit systems. These systems support economic growth and stability. Nigeria’s approach includes measures like the CBN blacklist. This list identifies entities like Icoin Loan that violate regulations. The blacklist serves as a tool to maintain integrity in the financial sector.

Role of Flutterwave and KARMA

Flutterwave plays a significant role in Africa’s financial landscape. The company provides seamless payment solutions across the continent. Businesses use the Flutterwave API key to integrate services efficiently. This integration enhances customer experience and expands market reach.

KARMA focuses on ethical lending practices. The organization works to ensure fair access to credit. KARMA collaborates with financial institutions to promote transparency. This collaboration helps build trust between lenders and borrowers. KARMA’s efforts align with global standards for responsible lending.

Future of Lending in Africa

Trends and predictions

The future of lending in Africa shows promising trends. Digital platforms like Lendsqr lead the way in innovation. These platforms offer quick access to credit for individuals and businesses. Technology drives efficiency and reduces barriers to entry. Experts predict continued growth in mobile lending solutions.

Credit accessibility will expand across rural areas. This expansion supports economic development and financial inclusion. Partnerships with tech companies like Flutterwave enhance service delivery. These partnerships create opportunities for new products and services.

Challenges and opportunities

Africa faces challenges in the lending sector. Regulatory compliance remains a key concern for financial institutions. Entities must adhere to guidelines to avoid blacklisting. Organizations like KARMA help navigate these challenges by promoting ethical practices.

Opportunities abound in the evolving financial ecosystem. Companies can leverage technology to reach underserved markets. Innovative products can address specific needs within communities. Collaboration with stakeholders ensures sustainable growth. The future holds potential for transformative change in Africa’s lending landscape.

Understanding the dynamics between Icoin Loan and the CBN blacklist is crucial. The insights gained highlight the importance of due diligence in financial decisions. You must ensure that decisions align with relevant information and regulations. This approach helps maintain adequate capital and audit functions. Navigating financial regulations requires a risk-based approach. Credit plays a significant role in this landscape. A clear understanding of credit systems helps you make informed choices. Icoin Loan’s inclusion on the blacklist emphasizes the need for vigilance. The financial ecosystem demands awareness and proactive measures.