Choosing the right bank for a loan can significantly impact your financial future. Sterling Bank Loan offers a compelling choice with its customer-friendly features. The bank has established a strong presence in the market, known for its innovative approach and commitment to customer satisfaction. Sterling Bank Loan provides accessible and efficient solutions tailored to meet diverse needs. Consider Sterling Bank Loan as a viable option when seeking financial assistance.

Unique Features of Sterling Bank’s Loans

Quick Approval Process

Sterling Bank Loan offers a quick approval process. Time efficiency stands as a key feature. Customers receive loan approvals in as little as 5 minutes. This rapid process saves valuable time for borrowers. Customer convenience remains a priority. Sterling Bank Loan ensures a smooth and hassle-free experience. The bank’s commitment to efficiency makes it an attractive choice.

Lack of Collateral Requirement

Sterling Bank Loan does not require collateral. Accessibility increases for more customers. Individuals without assets can still access loans. This feature opens doors for many potential borrowers. Risk management becomes easier for customers. Sterling Bank Loan provides peace of mind. Borrowers face fewer obstacles when seeking financial assistance.

Specta Offering for Non-Customers

Specta stands out as a unique offering from Sterling Bank Loan. Inclusivity defines this service. Non-customers gain access to loans through Specta. This feature broadens the bank’s reach. Flexibility in loan options enhances customer satisfaction. Sterling Bank Loan caters to diverse financial needs. Specta represents innovation and accessibility in banking.

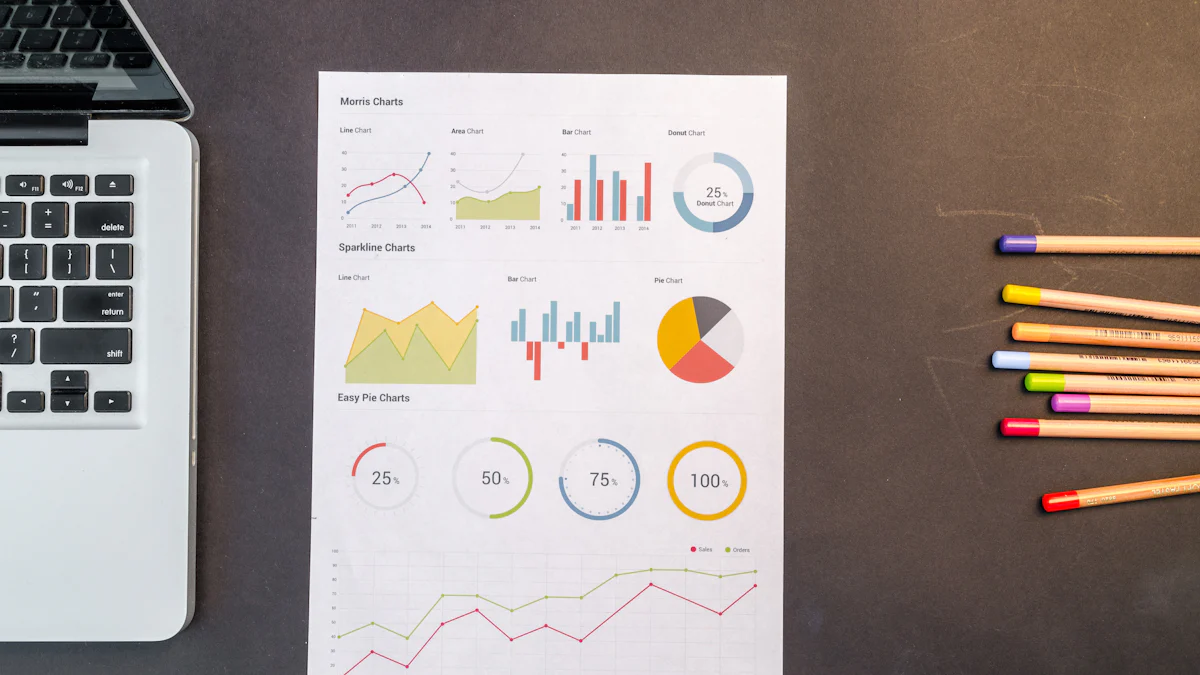

Interest Rates Comparison

Competitive Rates for Personal Loans

Sterling Bank Loan offers competitive rates for personal loans. Many banks charge higher interest rates. Sterling Bank Loan provides a better deal. Borrowers save money with lower rates. Sterling Bank Loan stands out in the market. Customers enjoy financial relief. The bank’s rates attract savvy borrowers. Sterling Bank Loan ensures affordability.

Special Rates for SMEs

Sterling Bank Loan supports small businesses with special rates. Entrepreneurs benefit from these favorable terms. Sterling Bank Loan encourages growth in the business sector. Small businesses thrive with financial support. Sterling Bank Loan contributes to economic development. Communities see positive impacts. Sterling Bank Loan fosters innovation and expansion. Business owners find opportunities with Sterling Bank Loan.

Technological Advancements

SnapCash

SnapCash offers a seamless experience for users. The platform simplifies transactions with an intuitive interface. Users can transfer funds quickly and efficiently. SnapCash ensures that every transaction remains secure. Advanced encryption protects user data. Sterling Bank Loan prioritizes your safety and convenience.

Other Digital Innovations

Sterling Bank Loan embraces digital transformation. The OneBank App provides comprehensive online banking services. Users can manage accounts from anywhere. The app supports global fund transfers and online payments. Customers can purchase airtime and create virtual cards. These features enhance the banking experience.

Mobile app functionalities offer additional benefits. Users enjoy real-time notifications and account updates. The app allows easy access to loan information. Sterling Bank Loan ensures that technology meets customer needs. The bank’s commitment to innovation sets it apart. Choose Sterling Bank Loan for a modern banking solution.

Sterling Bank Loan offers several advantages. Quick approval, no collateral requirement, and competitive interest rates stand out. Technological advancements enhance the banking experience. Some drawbacks include higher interest rates for certain customers. Consider Sterling Bank Loan for your financial needs. Evaluate personal circumstances before making a decision. Sterling Bank Loan provides a modern and efficient solution. Choose wisely to secure a better financial future.